Indian IT’s preparation for the upcoming winter is making everyone feel the chill. Be it the freshers who didn’t receive the offer letters after months of waiting or mid-level employees who didn’t get variable pay or even the leadership team that is witnessing a series of resignations “to pursue other interests”.

Last week, TCS CEO Rajesh Gopinathan decided to step down from his role and as his replacement, K Krithivasan was given the new position of CEO-designate. This came shortly after Tech Mahindra replaced its MD and CEO with Mohit Joshi, previously a director at Infosys. Another major announcement in the sector was Ravi Kumar, the former president of Infosys Global Services Organisation, leaving the company to become the global CEO of Cognizant.

When it comes to leadership, HCL Tech’s Engineering and R&D head, Sukamal Banerjee stepped down from his position. Ranjan Kohli, who was in charge of WIPRO’s Integrated Digital, Engineering and Application Service Business Line, also resigned as per media reports.

Why is this happening?

While both the top guns of TCS and Tech Mahindra are reflecting rather positive signs to the media, the reason behind the resignations is far more grave.

For instance, while stepping down as the CEO of TCS, Rajesh Gopinathan asserted that his decision was rooted in wanting to pursue other interests. Although, many industry experts believe that the real reason behind the decision is something else.

It was the first time that a TCS CEO was stepping down on their own. The IT giant has seen a relatively stable leadership when compared to its rivals, with only four CEOs since the establishment of the company. Gopinathan too was reappointed as the CEO for a five-year term until February 2027 last year.

However, in Gopinathan’s second term, TCS couldn’t achieve the growth it had anticipated. While TCS recorded an inclination towards research under the leadership of Gopinathan, the company could not manifest the same success with the revamp in the organisation—leaving both investors and employees unhappy.

Additionally, as reported in January, the macro slowdown of TCS with fewer deals and a negative headcount might have also pushed Gopinathan to this decision.

In the third quarter of FY23, TCS received new orders worth $7.6 billion which, compared to the previous quarter ($8.1 billion), showed a decline by 3.7%. The book-to-bill ratio—which is the ratio of orders received to units shipped and billed for a particular period—also declined to 1.07x in Q3 2023. In Q3 2022, it was around 1.17x while the historical average since Q1 2019 is around 1.24x.

In an increasingly identical manner, while interacting with the media, Tech Mahindra’s Gurnani attempted to assert that everything was under control by putting out statements like, “I became a CXO at the age of 38 and am now stepping down at the age of 65. All I’m trying to say is that I’ve been a playing captain for a very long time. I will become a coach. I will no longer be a playing captain”. But, even with such open reassurance, all did not seem well at Tech Mahindra.

For the past couple of months, Tech Mahindra was trying to find a replacement for Gurnani in the internal leadership team, with Manish Vyas, Jagdish Mitra, and Lakshmanan Chidama being the first choice. However, the company had to take a bet on an outsider like Joshi, who had a far better record at Infosys than its own leadership pool. The tech giant is also facing problems in Europe and USA to bag significant deals. Additionally, from the past couple of quarters, Tech Mahindra did not record positive results in its quarterly results as well.

In FY23 Q3, Tech Mahindra recorded a 5% decline in its quarterly profit, citing a challenging economic climate. The IT firm’s net profit for Q3—ending December 31, 2022—was INR 1,296.6 crore, decreasing from the previous year’s INR 1,368.5 crore.

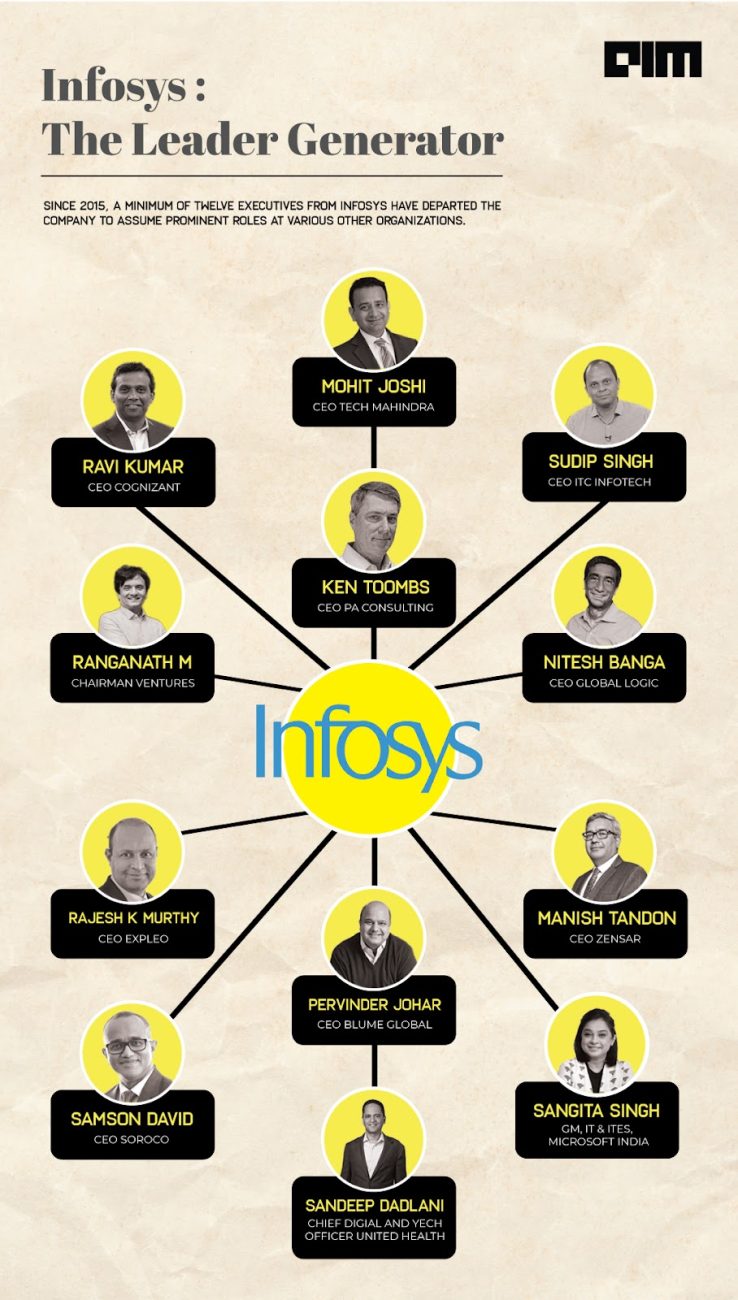

Infosys, the real leader generator

With all the reshuffling going around in the Indian IT sector, one thing that is constantly talked about is how Infosys has now emerged as the new leader generator, with several from its leadership team leaving and taking the positions of CEOs in different companies.

Mohit Joshi and Ravi Kumar are just the tip of the iceberg when we see the long list of ex-Infosys employees currently in leading roles. Before Kumar, there were at least twelve leaders who’d left the company to take significant positions at different companies.

This is due to a very peculiar reason. All the Infosys founders, at a very early stage, had declared that their children won’t be becoming the CEOs in future. That led to Matthew Frank Barney, the then head of leadership development at Infosys Leadership Institute, seeking a structured way to look at and develop leaders.

The company follows a three-level process to identify potential leaders. In the first level, the company scouts for 50 Infoscians with approximately 15 years of experience—holding positions as geographical heads or business unit heads—who have the potential to join the board within three to five years.

Moving on to the second level, the focus is on finding leaders who can either make it to the first level or lead a business unit within three to five years. The company seeks at least 150 employees—including vice-presidents and those reporting to unit heads—who possess around ten years of experience.

Finally, at the third and last level, the search is for leaders who can progress to the second level. The company selects from a pool of approximately 550 business and technology managers who are associate VPs or below, having five to seven years of experience.