Looks like the great Indian startup party has come to a halt due to layoffs, shutdown, and funding crunch. According to market estimates in the last few months, the Indian tech startups, including a few unicorns such as Vedantu, Cars24, MFine, and Meesho – to name a few – have laid off close to 6000+ people as a measure to cut costs and extend their runway.

But, the same is not the case with Indian IT companies as they are on a hiring spree despite the global downturn. Around 40-50 per cent of employees leaving startups are getting absorbed by IT companies, consulting and product companies and global captive centres (GCCs).

IT, GCCs to the rescue

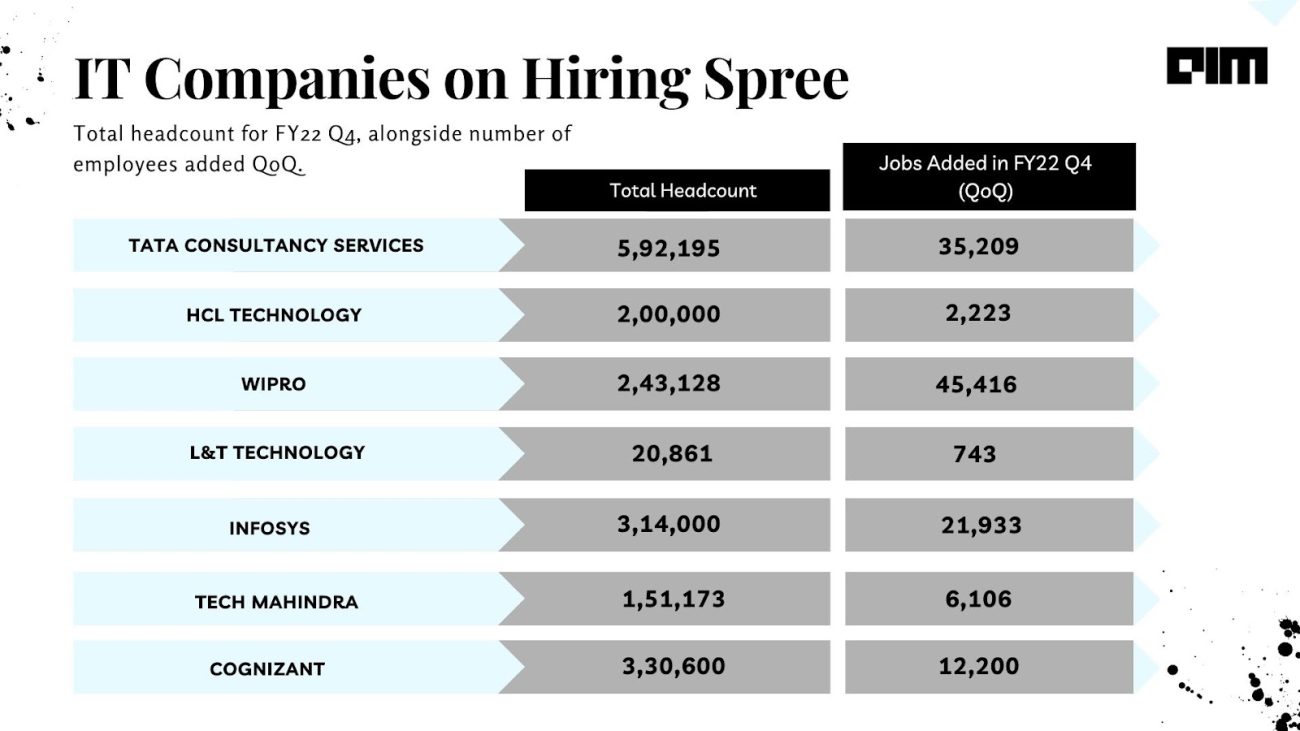

The Indian IT companies are expected to hire close to 3.6 lakh freshers in FY22, as per cognitive intelligence platform UnearthInsight. For instance, IT giants Infosys and TCS recruited about 1.9 lakh freshers in the fiscal year 2022, indicating that the IT sector will continue to be on top of the game this financial year.

Here’s a quick look at the total headcount of employees across IT companies, alongside the number of jobs added in FY22 Q4.

India has about 1,500 GCCs across sectors. This includes banking, financial services, BFSI, automotive, IT software, etc. As per an estimate based on hiring plans of existing and upcoming GCCs, the Indian-based captive centres of MNCs are set to increase employee count by 1.8-2 lakh by the end of this fiscal year. By 2025, 500 new GCCs are expected to set up their captive tech, and the total headcount is set to double to 3-3.2 million in the next three years, as reported by ET.

Further, the report stated that in the last one year, the cohort of companies together added about 1.7 lakh jobs in India, while gross hiring stood at 3.5 lakh.

The rise of captive centres can be attributed to the cost advantages and huge talent pool that the country has – particularly in technology – making India a strategic hotspot for multinational corporations (MNCs).

Are IT jobs stable?

The increasing headcount of the majority of these IT indicates a steady growth in team size. That is because most companies are offering great incentives, promotions, stability and job security for their employees.

For instance, in the case of TCS, the company believes that its focus on investing in people and its progressive workplace policies have helped them retain and hire more talent. HCL Technologies said that it had paid out a special milestone bonus to all of its employees in the March quarter of last year – i.e. close to USD 100 million – to be precise, USD 99.8 million. Of course, not to forget the Mercedes-Benz cars as a reward to top performers.

Many employees said they would rather move to a stable organisation even if they look at a pay cut.

But, at the same time, it is not that startups are not stable. Recently, various unicorns and pre-IPO startups have been hiring and growing their teams. Unfortunately, some of these companies have triggered negative sentiments among job seekers because of the layoffs. However, many experts believe that this will be corrected with time.

We started with *Great Resignation* in 2021 and moved to *Great Recession* in 2022

— Vineeth K (@DealsDhamaka) May 24, 2022

Layoffs in startups should add more workforce to the traditional IT companies which should cool down the attrition a bit#IT #GreatResignation

Oh, the ‘Great Resignation’

Meanwhile, the Indian IT sector has also succumbed to increasing attrition. Shortage of digital talent, alongside high demand for qualified professionals, and increased wages, has led to increased attrition.

As shown below, Cognizant has the highest attrition rate, followed by Infosys, Tech Mahindra, Wipro and others. However, the majority of the companies have reported some stability in quarterly attrition with better compensation and hikes, improved hiring, work-life balance, and others.

But, the question is, what are these numbers telling us? Credence Wealth Advisors’ founder Kirtan A Shah said that the attrition leads to reducing margins for the IT companies. In other words, companies have to increase salaries to retain or hire new talent. Also, the utilisation falls. For instance, in FY22 Q4, Infosys’ utilisation dropped from 88.5 per cent to 87 per cent.

Where is the talent heading?

The founder and CEO of Han Digital, Saran Balasundaram, told The Economic Times that the demand is across various roles, including full-stack engineers, data engineering, product management, DevOps, etc. Currently, the overall headcount of the IT industry stands at 5.1 million, out of which 4.2 lakh people are employed with startups – almost 20 per cent of this workforce left startups to join the IT industry in the last few years, he added.

As Shah pointed out, in the last two years, a lot of new-age tech startups were offering 2-3x salaries, ESOPs, etc., attracting talent from the old IT services companies.

Now, it looks like they are returning to the IT world.

“Startups’ may be ditched for stability,” said Shah. He said, along with a depreciating rupee, this can probably improve the operating margins for the IT sector going forward.